Households in every capital city will need a significant pay rise this year if they are hoping to enter the property market without being in mortgage stress, new analysis shows.

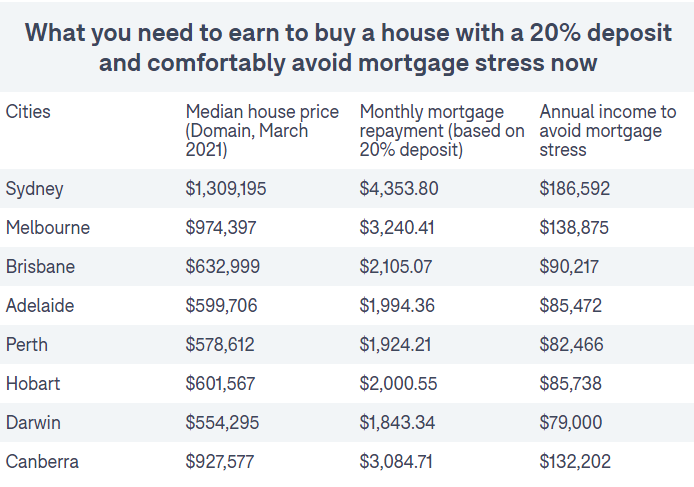

Financial comparison site RateCity has calculated the annual household income needed to buy now, based on current house price medians and comfortable mortgage repayments after laying down a 20 per cent deposit, and compared it with the projected annual household income needed to buy by the end of 2021.

Rate City found that if house prices reached the dizzying heights forecast by ANZ this year – rising by up to 19 per cent – households looking to buy would need up to $18,881 extra in their pay packet.

In Sydney, house prices are forecast to jump 19 per cent from the current median of $1,309,195 to $1,441,671 by the end of the year. While the annual income needed to avoid mortgage stress now is $186,592, by then that figure would hit $205,473. Mortgage stress is defined as paying more than 30 per cent of a household’s pre-tax income on the monthly mortgage repayments.

With that in mind, a salary increase or wage rise of this scale was unlikely, leaving many hopeful home owners priced out of big capital cities, according to RateCity research director Sally Tindall.

“It’s very much an uphill battle for anyone looking in Sydney and Melbourne who is trying to save for their first property,” Ms Tindall said. “Incomes just aren’t keeping up with property prices increases and that has the potential to start cutting people out of the market. And those people are most likely to be first-home buyers and low-income earners.”

Every capital city is forecast to record a double-digit increase in their median house price by the end of this year. Ms Tindall also urged prospective buyers to factor in future rate rises. “Even if you renegotiate your home loan, you need to factor in wiggle room to meet your monthly repayments.”

It is a similar picture for households looking to buy an apartment. Again, Sydney households face the brunt of the property pressures with an extra annual income of $16,742 needed to cover the projected median unit price of $868,510 without incurring mortgage stress.