The last two months have shown improvement in the recently sombre economic and housing markets; auction clearance rates have rebounded since the easing of restrictions and are proving to be not so different from this time last year; a rise in sales have absorbed high listing volumes; and a 33% rise in consumer confidence has been recorded since its lowest in May, according to CoreLogic.

But, employment indicators since the onset of Covid-19 bring about a cause of concern for what’s to come for the property market. With the impending expiration on mortgage holidays, and Government stimulus initiatives potentially pulling back, job and income levels are predicted to be subdued, particularly for those working in tourism, hospitality and the arts.

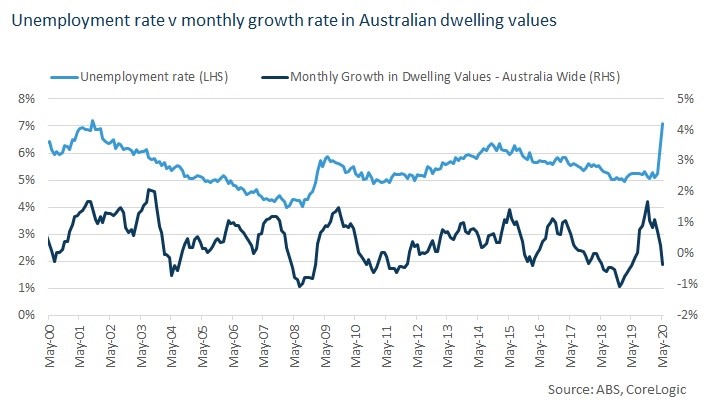

In recent months, labour force data unveiled that 835,000 fewer people were employed across Australia, inflating the unemployment rate to 7.1% in May, although this may not point to a fall in house prices; historically, housing growth rates have fallen when unemployment levels have fallen, and a rise in unemployment has been met with a rise in housing. Certain housing markets will do well when unemployment rises commonly due to lowering cash rates, allowing those who can still afford to buy do just that, as shown in the graph below.

However, recent data over May shows otherwise – unemployment at it’s highest in nearly two decades, combined with negative housing values.

The dampened conditions in the employment sector are predicted to be lasting due to many businesses needing to restructure or potentially unable to hire as many staff as they previously had. This may reduce the demand for housing because, although interest rates are at a record low, recovery in jobs and incomes will be necessary in increasing purchasing capacity of those still looking to secure a home.

It is possible that the significant job loss our nation has experienced may not directly threaten the housing market. Statistics show that, of those who suffered job loss in recent months, 59.7% were employed on a part-time basis, and 40% were aged between 15-24. CoreLogic suggests the typical first home buyer is aged between 25-34, meaning that it is unlikely many of those losing work in the younger age group would hold mortgage debt.

Despite this, there is no question that the economic impact of these job losses won’t remain significant, even if the impact is indirect, and current market trends present great selling conditions for those looking to transition into a new home or free themselves of their investment. If you need any assistance with your move, or want to have a conversation around your property plans, feel free to reach out to us on 02 4504 8004.