Sydney property prices are overvalued and Australian households are taking on more debt compared to their incomes to keep up, a new report from investment bank UBS has warned.

But there’s little relief in sight for homebuyers as property prices are likely to keep rising unless interest rates go up, the report said, a scenario the Reserve Bank views as unlikely before 2024.

It comes as AMP Capital chief economist Shane Oliver estimated Sydney house prices were as much as 39 per cent overvalued, on one measure, and units about 30 per cent, and forecast prices would keep rising next year but at a slower pace. The city had been overvalued since the early 2000s but the degree of overvaluation had varied, he said.

Elsewhere, NAB slightly revised up its dwelling price growth forecasts to 23 per cent during 2021 and a further 5 per cent in 2022 across the capital cities, from its previous expectations of 19 per cent this year and 4 per cent next year. It tipped growth for Sydney of 27.5 per cent, Melbourne of 18.8 per cent, Hobart of 28.4 per cent, Brisbane of 23.2 per cent and Perth of 14.5 per cent.

The property market has boomed over the past year as pandemic-era buyers armed with record-low interest rates, government stimuli and cash saved from cancelled overseas holidays chased larger accommodation while spending more time at home.

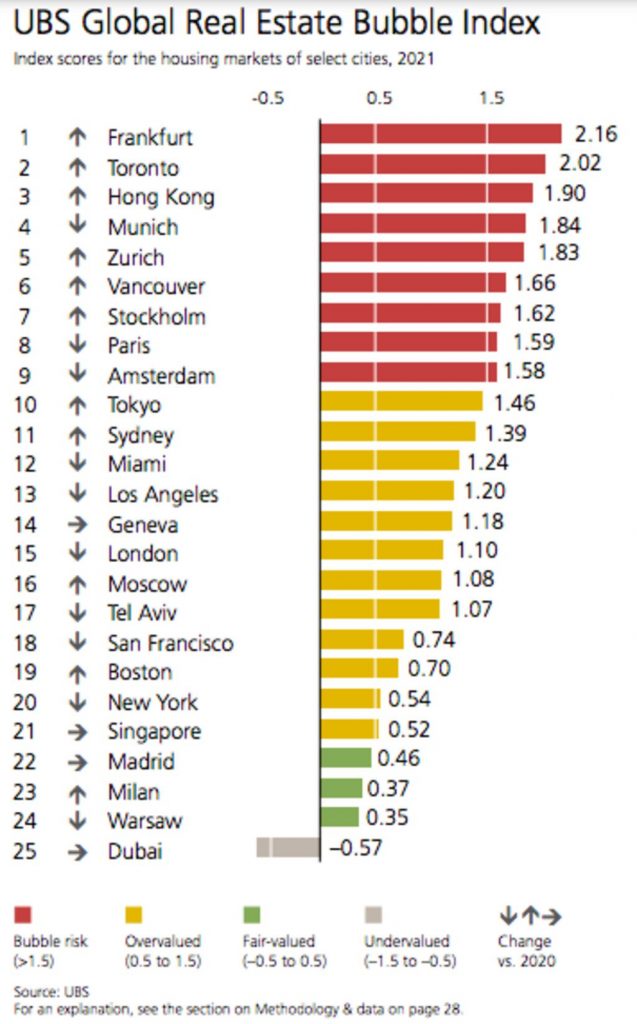

In its Global Real Estate Bubble Index for 2021, UBS found Sydney was more overvalued than London or New York, but it stopped short of calling the city’s housing market a bubble. Frankfurt, Toronto and Hong Kong topped the rankings of the cities with the most bubble risk.

Any city that scores over 1.5 points on the index is deemed at bubble risk. Sydney is at 1.39 and has risen to 11th place in the rankings.

“Households have to borrow increasingly large amounts of money to keep up with higher prices,” UBS warned. “As a result, the growth of outstanding mortgages has accelerated almost everywhere in the last quarters, and debt-to-income ratios have risen—most markedly in Canada, Hong Kong, and Australia.”

As for Sydney, a previous dip in the market was brief, property prices have posted new record highs, and they are likely to keep rising without an interest-rate hike, UBS said.

“Price growth has clearly outpaced local incomes, stretching affordability and thereby increasing dependance on easy financing conditions even further,” the bank said.

New listings continue to rise

As lockdown restrictions ease across Sydney, Melbourne and the ACT, the spring selling season is well and truly underway, and vendors are piling properties onto the market.

New listings have surged 28.2% nationally in the four weeks to mid-October, amounting to more than 45,000 new properties added to the market. The news could be a relief for buyers, because it means they have more stock to choose from after an extended period of relatively short advertised supply.