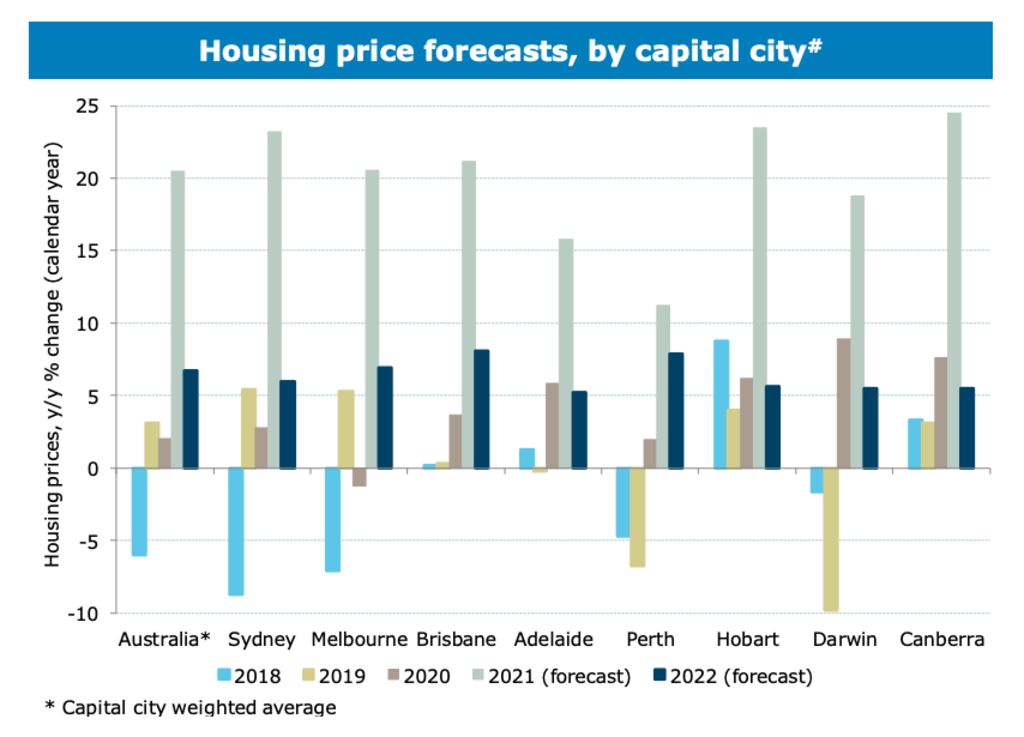

ANZ has tipped house prices to jump by more than 20 per cent this year, lifting its forecasts despite the lockdowns, off the back of the stronger than expected property market.

Property prices are expected to rise 24 per cent in Canberra by year’s end and 23 per cent in Sydney and Hobart, according to the bank’s latest forecasts, released on Wednesday. Gains of 21 per cent and 20 per cent are expected in Brisbane and Melbourne, respectively.

ANZ is the latest of the big banks to revise its forecasts upwards amid lockdowns, which ANZ senior economist Felicity Emmett said were unlikely to derail the strength of the housing market. “[We’ve updated our forecasts] because of how strong prices have been; that includes through the lockdown period,” Ms Emmett said. “We did think by this time of the year that the momentum in prices would have pulled back.”

Instead, even in Sydney – which has been in lockdown for two months – prices continued to climb.

“When you look at some of the leading indicators, auction clearance rates, sales to listing ratios, you can see the market is still very very tight and there hasn’t been much of a drop-off in demand or interest in the face of these quite heavy lockdowns,” Ms Emmett said.

In Melbourne, where the clearance rate had been harder hit by lockdown restrictions – which include a complete ban on property inspections – prices were still holding up well, Ms Emmett added.

In Sydney, the most expensive capital city, the average home value was more than nine times the average income, and housing affordability had deteriorated across all metrics and all states, with rental affordability also deteriorating sharply, the ANZ report noted.

On top of affordability limitations, Ms Emmett said she still expected to see macroprudential controls introduced to cool the market as investor financing surged and credit growth outpaced incomes growth by a significant margin. However, she noted the economic impact of the latest lockdowns would likely delay any intervention by the regulators.

“Interest rates are staying low for some time; they’re driving a lot of the market, and we’re seeing high borrowing … I think regulators will be concerned by the fact the growth in debt is so much higher than incomes,” she said.

While household debt levels are concerningly high, low interest rates have enabled people to get further ahead on their repayments. Almost 40 per cent of owner-occupiers with mortgages have over a year of prepayments in their loans or offset accounts, as do about a third of investors, the report noted. Housing debt as a multiple of household income was also down a little from its 2019 peak.

Ms Emmett did not hold concerns about an increase in forced sales amid lockdown. While arrears have drifted up over the past year, the general trend was not that different to that of past decades, and arrears were still low by international standards. Rapidly rising prices had also materially reduced the number of loans with negative equity, the report said. She added loan deferrals were also well down on the levels seen in the early stages of the pandemic.