Recent forecasts from Treasury indicate annual population growth across Australia is set to slow from 1.4% pre-COVID, to 0.6% through the 2020/21 financial year. If these forecasts are correct, the rate of population growth (a partial indicator for housing demand) will be the lowest since 1917. Most recent statistics suggest the decline in population growth is due to lack of overseas migration, which is expected to drop from approximately 232,000 net migrants in the 2018/19 financial year, to just 31,000 in 2020/21, with the impact affecting different markets.

In the last thirty years, net overseas migration has accounted for 51% of Australia’s population growth, according to CoreLogic. Taking into consideration the different types of migrants paints the picture of how this shift will play a key role in the housing market. For example, temporary migrants, those most likely to rent instead of buy, make up 70% of Australian migrants, many of them classified as students or visitors. A sharp drop in migration rates is likely to bring about a weaker rental demand in this regard, rather than affect sales demand. Geographically, Sydney and Melbourne will be impacted the most.

A higher volume of rental listings and a decrease in rental values may mean investors are looking at higher vacancy rates, with the potential of more forced sales in affected areas. This could in turn increase the supply of sales listings, which could potentially work to match the buyer demand that has remained fairly consistent in the last few months.

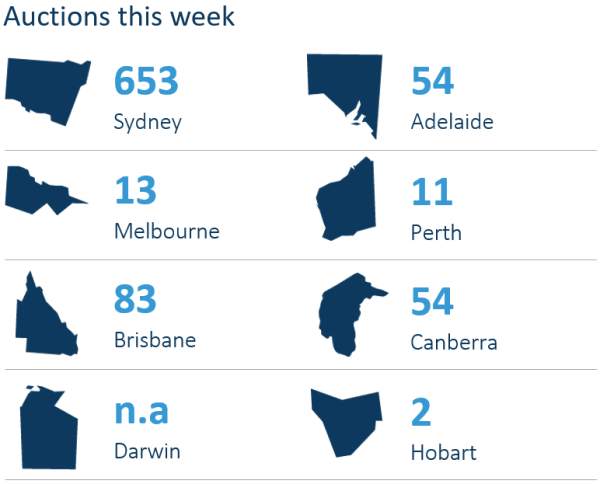

Spring is usually the busiest time of year for the Sydney housing market, and despite a change in pattern throughout Winter due to Covid, we’re set to have a heavy auction weekend ahead. There are 870 capital city homes set to go under the hammer this week, according to CoreLogic, similar to last week when 866 auctions were conducted. This time last year, 1639 were taken to auction across the combined capitals.

With Melbourne in stage 4 lockdown, they have reached a record low in their respective auction market with just 13 auctions set for this week, down from 826 the same week in 2019, which is an indicator as to why the entire number of scheduled auctions is down across capital cities. As for Sydney, which has 653 scheduled auctions for this week, it appears the number of auctions held are constantly tracking higher than this time last year, which has been the case since mid-June. With travel and school holidays affected, seasonally, numbers have been more consistent than usual and the market has remained resilient.

With the end of the year drawing closer, if you have property plans you wish to be finalised before the close of 2020, you’ll need to be on the market soon. Taking into consideration a couple of weeks for preparation, a 4 week marketing campaign and a 6 week settlement now is the time to start the conversation. If you would like assistance with your next steps, reach out to us on 02 4504 8004.