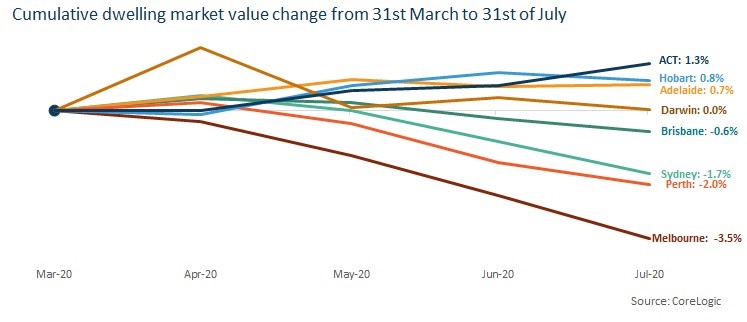

Since the arrival of Covid-19, it appears each Australian Capital City’s housing market has performed differently. Recent data from the CoreLogic Home Value index reveals that, since March, Melbourne house prices have fallen 3.5%, whilst the ACT dwelling market reached a record high. Rates of decline eased throughout June and July for Perth, but deepened for Sydney and Melbourne, as shown in the chart below.

Unsurprisingly, Melbourne have so far experienced the largest collective decline in property values since March, which has been likely attributed to the fact Melbourne usually receives the highest level of overseas activity compared to the other capital cities, now of course dampened by the closure of international borders. Sydney’s decline can be pinned similarly to the close of international boarders, being the second highest city in terms of volume of interstate migrants.

Many sellers across Sydney are realigning their price expectations amid the pandemic as a result of these figures. According to Domain, Sydney’s market is seeing a broader number of properties being discounted, with price reductions most commonly occurring in the Northern Beaches. “We haven’t seen the bottom fall out of the property market, prices haven’t collapsed. We’re just seeing more sellers having to be a bit more realistic about what they can achieve” said Domain senior research analyst Nicola Powell.

What’s to come?

Housing conditions will certainly be tested more broadly in October when the Government reduces its fiscal support from around $18billion per month to around $3million per month. We will likely see a rise in those facing financial stress and in need of an urgent sale. The expiry of mortgage repayment holidays may also play negatively in the market, with the expectation that any debts are repaid by April next year. Whilst trends point to potential downturn, the outlook for the housing market still remains extremely uncertain.

If you wish to discuss how the current market affects your property plans, please reach out to us on 02 4504 8004.