An analysis of listings in cities around the world has shown that the more intense the lock down, the quicker the bounce back for the property market.

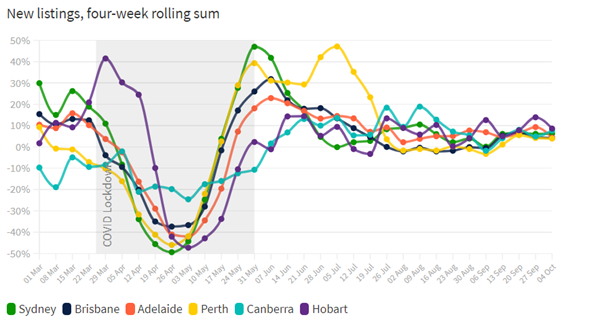

A recent analysis by Domain found that new property listings in Australia, New Zealand, UK and the US all fell significantly during respective lockdowns, but the rebound has varied depending on the severity of the lockdown.

In New Zealand and the UK, where lockdowns were very strict and caused a shutdown of the housing market, the rebound and new listings and sales volumes was very strong: it would seem that the longer the lockdown, the more people there are waiting to transact and make a move on property, causing a strong rebound.

Melbourne has also seen a rapid rebound in listings since stage 4 real estate restrictions which involves the ban of in-person inspections, started to ease in early October. Domain data revealed weekly listings dropped by up to 70 per cent during the most recent lockdown – compared with the 40 to 50 per cent drop seen by most Australian capitals during the stage 3 restrictions earlier in the year. However, by the 4th of October, weekly listings bounced back an immense 241% than in the previous week.

Different countries seem to have performed differently in this regard though. In the US, for example, where Covid-19 lockdowns were generally less strict, buyers were still able to transact. Listings in capital cites of the US saw quite a drop in April, then slowly rose over the following 12 weeks to where listing numbers were in the previous year – still an increase but different to rapid jumps as shown in other countries. New York was an exception; with a stricter lockdown, listings jumped much higher than in the previous year, according to a Domain analysis. AMP Capital chief economist Shane Oliver said this effect is not necessarily the market taking off, it’s more a sign the market has returned to normal.

With the offering of Government grants in Australia and the continued low interest rates, it’s no surprise many people are finding now is the right time to make a move; a recent survey conducted by Westpac recorded an exceptional surge in consumer confidence, and we’re definitely seeing plenty of activity from buyers with a keen appetite to purchase.

If you are looking to make a move, especially before Christmas, get in contact so we can assist you.