In previous years, the Australian property market usually experiences a slowdown over winter with notably less activity with the cooler change in season. For 2021, however, experts are suggesting strong buyer demand paired with unseasonably high sales volumes indicate price growth will continue throughout the winter season.

Director of economic research at realestate.com.au, Cameron Kusher, said while he is not expecting an early spring for the housing market, the COVID-induced property boom is showing no signs of a dramatic slowdown over the coming months. “We are still seeing weekly preliminary sales at volumes similar to spring of last year and demand remains at very high levels. While it won’t be the new spring, the winter housing market looks set to be much more active than what we see in a typical year.” Mr Kusher added “New listing volumes have risen over recent months, but I would still expect there will be many sellers that decide to wait out the next few months and list their homes for sale in spring.”

Australia’s two biggest auction markets, Sydney and Melbourne, are heading into a big auction weekend for the first weekend of winter, with 1021 auctions currently scheduled in Sydney and 1393 scheduled in Melbourne, although that number is expected to be impacted by an extended lockdown.

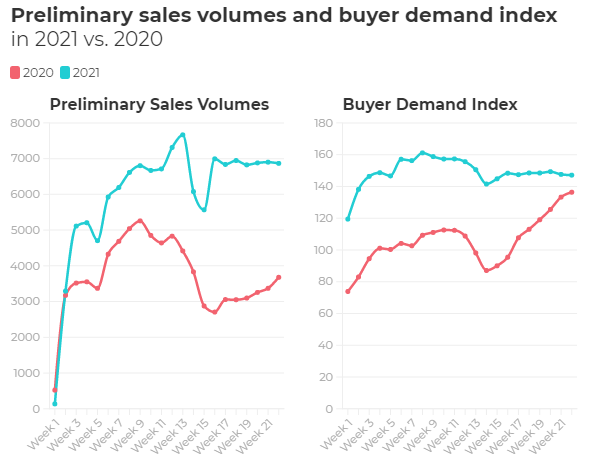

Realestate.com.au data also confirms that buyer demand and number of sales are currently much higher than figures for this time last year.

Record low interest rates continue to be a driving force for such buyer activity. The low costs of borrowing and the likelihood that these costs will remain low for a number of years means buyers have some comfort in securing their purchase, which has undoubtedly a contributor to the strong market conditions that are favouring sellers at present.

My Kusher added that whilst it is expected that prices will rise over winter, reduced demand and the removal of some stimulus will cause prices to rise at a slower pace, with the second half of this year expected to move forward with less strength than in the first half.