As days on market increase and existing stock remains, the number of available properties too increases, jumping to 11 percent for both Sydney and Melbourne in May. Statistics showed that Sydney properties listed on the market for more than 2 months have reached 15,746 – up by 44.4 percent compared with the statistics from a month ago.

Such a rise in property listings can be attributed to the slowed pace that buyers are able to transact, given the current circumstances. With evident unemployment and toughened lending criteria from banks, many buyers are either cautious to transact due to the concerns over job security, or are sticking out the wait until their finance is approved, despite an enthusiasm to secure a home.

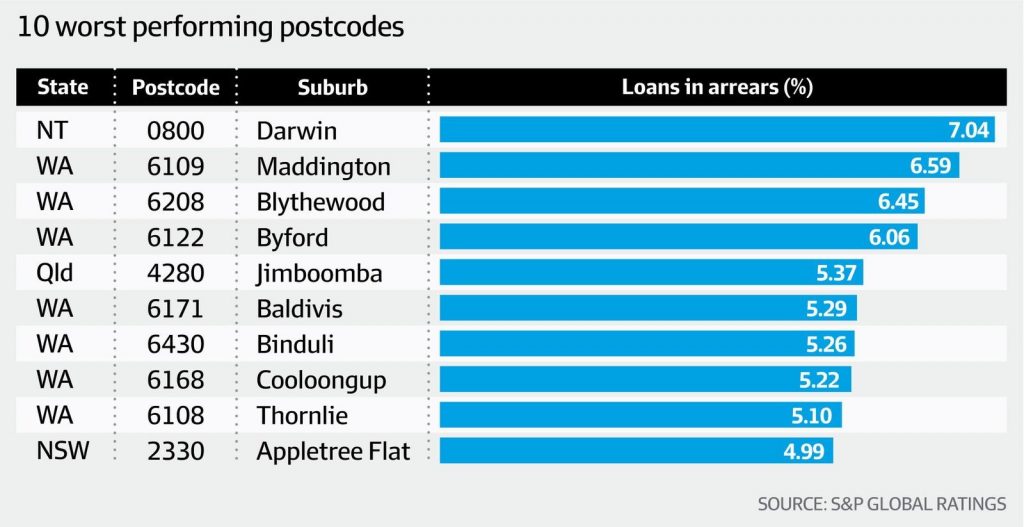

Experts predict worse conditions towards the tail end of this year once repayment holidays come to an end in September and consumers feel the full weight of financial stress. Mortgage arrears statistics show a rise to 1.42% in NSW for the first quarter of 2020, although not the worst performing area as shown in the graph below.

It may not be all negative though – the fact is that median house prices in Sydney are still up by 3.9% this year, and overall higher than they were 12 months ago. Out and about there is a definite feeling of spirits lifting, and healthy signs of activity. There are plenty of vendors interested in testing the market, and many buyers ready to go.

The way we see it, if you have a sustainable income source and an appetite to purchase, or you have a desire to sell to attain that change of scenery, conflicting media or not there is no greater time than the present.

Reach out to us on 02 4504 8004 so we can best assist you with you property plans.